Understanding chargeback reason codes is essential for managing payment disputes effectively. These alphanumeric codes represent specific reasons for chargebacks, like fraud or processing errors. By recognizing these codes, you can identify root causes, helping to enhance your business's security and operations. Each card network has its own system for categorizing these reasons, making it easier for you to tackle disputes efficiently. Implementing robust fraud detection tools and engaging with customers proactively can minimize these incidents. If you're keen to enhance your knowledge further, there's so much more to discover about these important codes and how they affect your business.

Key Takeaways

- Chargeback reason codes are alphanumeric identifiers that categorize payment disputes and are essential for effective management and analysis.

- Each card network, including Visa, Mastercard, and American Express, has its own system for classifying chargeback reasons, ensuring structured dispute handling.

- Understanding common chargeback fraud schemes, such as friendly fraud and card-not-present transactions, is crucial for revenue protection.

- Effective communication and robust fraud detection tools are vital strategies for merchants to minimize misunderstandings and reduce chargebacks.

- Responding to chargebacks with strong evidence and tailored documentation significantly increases the chances of successful dispute resolution.

What Are Chargeback Reason Codes?

Understanding chargeback reason codes is essential for maneuvering payment disputes effectively. These alphanumeric codes, typically ranging from 2 to 4 digits, signify specific reasons for payment disputes initiated by cardholders against merchants. Each major card network, including Visa, Mastercard, American Express, and Discover, uses distinct coding formats and categories to represent these disputes.

By familiarizing yourself with common financial terms such as credit score, you can better understand how they may impact your business's financial health.

Established by the Fair Credit Billing Act of 1974, chargeback reason codes categorize issues into types like fraud, authorization problems, processing errors, and customer disputes. When you grasp these codes, you can identify the root causes of chargebacks and develop strategies to address them.

For instance, if a significant number of disputes arise from fraud, you may need to enhance your security measures during transactions. Conversely, if processing errors are frequent, it might highlight the need for improved internal systems.

With Visa's extensive chargeback codes, you can further analyze and manage your chargeback occurrences effectively. By understanding what each code means, you can better protect your business from financial losses and improve customer satisfaction through better handling of disputes.

Importance of Chargeback Reason Codes

Chargeback reason codes are essential for merchants looking to navigate the complexities of transaction disputes. These codes help you pinpoint the specific reasons behind chargebacks, aiding in effective dispute management and resolution. By understanding the codes, you can assess the validity of claims and determine when to engage in the representment process.

| Chargeback Reason Code | Description | Impact on Business |

|---|---|---|

| 10.1 | Fraud – Card Not Present | High risk of revenue loss |

| 13.1 | Product Not Received | Indicates customer dissatisfaction |

| 15 | Credit Not Processed | Highlights processing errors |

| 41 | Cancelled Recurring Transaction | Reveals customer behavior trends |

Accurate categorization of chargeback reason codes can reveal trends in customer behavior. This insight allows you to implement targeted merchant strategies to reduce chargebacks. Additionally, effective fraud detection can help you minimize losses and enhance customer satisfaction. With the right approach, you can turn these challenges into opportunities for growth and improved customer relationships.

Chargeback Reason Codes by Card Network

Different card networks have their own systems for categorizing chargeback reason codes, making it easier for merchants to manage transaction disputes.

For instance, Visa employs the Visa Claims Resolution initiative, organizing its chargeback reason codes into categories like Fraud (10), Authorization (11), Processing Errors (12), and Customer Disputes (13). This clear structure helps you quickly identify the nature of a dispute.

Additionally, understanding the chargeback process can improve your overall free SEO keywords acquisition, enabling merchants to create content that addresses common customer concerns.

Mastercard, on the other hand, uses a four-digit system starting with 48XX, consolidating various reasons into broader categories since 2018. This approach streamlines the Mastercard chargeback process, allowing you to handle disputes efficiently.

American Express adopts an alphanumeric format for its chargeback reason codes, which also fall into categories such as Fraud, Processing Errors, and Customer Disputes, with an additional Miscellaneous category for unique cases.

Discover simplifies matters further by using an alphabetic system for its chargeback reason codes, benefiting from its dual role as both an issuer and a network.

Common Chargeback Fraud Schemes

Several common chargeback fraud schemes can greatly impact your business's bottom line. Understanding these schemes is essential for protecting your revenue and minimizing losses. Here are three prevalent types:

1. Friendly Fraud: This occurs when customers claim unauthorized transactions to bypass return policies, resulting in an estimated $25 billion loss annually for businesses.

It complicates the resolution process because it mixes legitimate and illegitimate chargebacks. Emotional manipulation often plays a role in these scenarios, similar to the challenges faced when divorcing a partner with BPD.

2. Card-Not-Present Transactions: This scheme involves using stolen credit card information to make purchases online without the physical card.

It's a significant issue for online retailers, as it often leads to chargebacks. The impulsive behavior associated with such fraudulent activities can mirror the emotional instability seen in relationships affected by BPD.

3. Fraudulent Multiple Transactions: According to major card networks, this chargeback reason falls under specific reason codes, such as Visa's code 57.

Here, customers make several purchases with no intention of keeping the items, leading to illegitimate chargebacks.

Understanding the Dispute Process

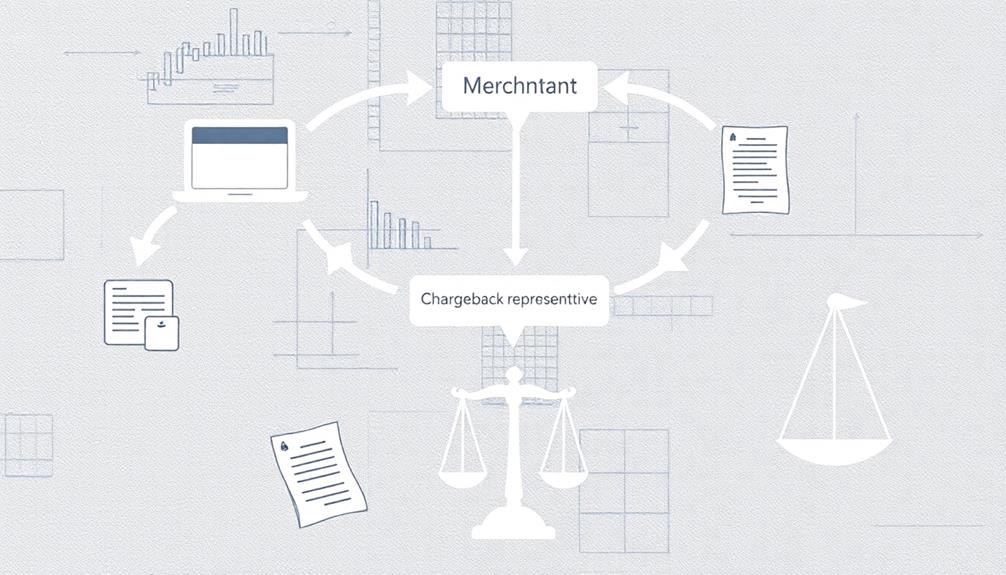

Steering through the dispute process can feel overwhelming, but understanding how it works is fundamental for any merchant facing chargebacks. The process kicks off when a cardholder requests a chargeback from their issuing bank, triggering an investigation into the transaction in question.

Each card network sets specific time limits, typically allowing cardholders up to 60 days to file, while you usually have 30 days to contest the chargeback. As businesses increasingly move towards digital transactions, the significance of understanding chargeback processes and maintaining strong customer relationships becomes paramount, especially in the domain of AI online jobs.

To effectively challenge a chargeback, you can utilize your representment rights. This means providing compelling evidence tailored to the specific chargeback reason codes that categorize the nature of the dispute. Relevant transaction records, proof of delivery, and any other documentation supporting your case are essential for a successful contest.

If your dispute isn't successful, the chargeback may escalate to pre-arbitration, where further negotiations take place before reaching a final arbitration decision. This can be a lengthy and costly process, making it important to engage actively and promptly.

Understanding the dispute process helps you navigate these challenges and improve your chances of a favorable outcome.

Prevention Strategies for Merchants

To prevent chargebacks, you need to focus on effective communication and robust fraud detection tools.

By clearly outlining your product details and return policies, you can minimize misunderstandings that lead to disputes.

Additionally, implementing strong fraud detection measures helps catch suspicious transactions before they escalate into chargebacks.

Regular checks on credit card statements can also aid in financial management and help identify potential issues early on.

A proven track record in payment processing enhances merchant reliability, which can further reduce chargeback occurrences.

Effective Communication Practices

Effective communication practices play an essential role in preventing chargebacks and fostering positive customer relationships. When you prioritize clear and proactive communication, you can effectively reduce misunderstandings that often lead to disputes.

Here are three key strategies for effective communication:

- Detailed Product Descriptions: Confirm your product descriptions are accurate and thorough. This helps minimize consumer dissatisfaction and reduces the chances of customers disputing a chargeback.

- Order Confirmations and Notifications: Send timely order confirmations and shipping notifications. This transparency enhances the customer experience and combats the perception of unauthorized transactions.

- Solicit Feedback Regularly: Actively ask for feedback about the purchasing experience. This not only uncovers potential issues before they escalate but also shows customers you value their input, thereby improving overall satisfaction.

Training your staff on effective communication techniques is vital. A well-informed customer service team can handle inquiries promptly, addressing concerns before they escalate into chargebacks.

Robust Fraud Detection Tools

Frequently, merchants face the challenge of chargebacks due to fraudulent transactions, which can greatly impact their bottom line. To combat this, implementing robust fraud detection tools is essential. These tools can markedly reduce chargebacks by identifying and mitigating fraudulent transactions before they occur.

Advanced systems, like Chargebacks911®'s Intelligent Source Detection™, analyze transaction patterns and anomalies, effectively pinpointing potential chargeback triggers. Understanding the importance of efficiency in system performance, similar to how heat pumps enhance energy use in refrigeration cycles, can aid merchants in optimizing their fraud detection strategies.

Machine learning algorithms are key in this process, continuously adapting to evolving fraud tactics, which enhances security and minimizes false declines. By integrating fraud detection with your payment processing systems, you streamline transaction approvals, ensuring legitimate transactions pass smoothly while flagging suspicious activities for further review.

Understanding fraud categories and utilizing reason codes help you respond effectively during the chargeback process, ultimately improving your chargeback management strategies. Regular updates and staff training on the latest fraud detection technologies empower you to stay ahead of emerging threats.

Responding to Chargebacks Effectively

Steering chargebacks can be challenging, but with the right approach, you can greatly improve your chances of a favorable outcome.

A well-organized response can reduce stress levels, promoting a sense of calm during the dispute process. To respond effectively, consider these key strategies:

- Gather Strong Evidence: Compile transaction details, shipping information, and customer communication to support your case during the dispute process.

- Tailor Your Response: Customize your responses based on each chargeback reason code. One-size-fits-all approaches often lead to low success rates. Implementing the art of decluttering strategies can help streamline your evidence.

- Monitor and Adapt: Keep an eye on potential reclassification of chargebacks. As disputes evolve, your response strategy may need adjustments.

Navigating Representment Rights

When you face a chargeback, understanding the representment process is key to defending your transaction.

A solid grasp of the benefits of merchant account credit processing can also enhance your defense strategy, as it provides insight into secure payment practices.

You'll need to gather the right documentation to support your case and tackle common challenges along the way.

Let's explore how to effectively navigate your representment rights and improve your chances of success.

Representment Process Overview

Steering through the representment process can be essential for merchants looking to dispute chargebacks and protect their revenue.

By effectively challenging the validity of a chargeback claim, you can reclaim funds and maintain your business's reputation. Understanding the legal context surrounding disputes, such as the divorce process in Berlin, can provide insight into the importance of documentation and timelines.

Here are three key steps to navigate the representment process:

- Gather Documentation: Collect all relevant evidence, including transaction details, shipping information, customer communication, and proof of authorization. This documentation is vital to support your case against the chargeback.

- Understand Reason Codes: Familiarize yourself with the specific reason codes associated with the chargeback. Each code may require different types of evidence, so knowing what you're up against can help tailor your response.

- Act Promptly: Be aware of the time frames set by card networks for representing chargebacks, which can range from 30 to 120 days. Timeliness is key in the representment process, as delays can jeopardize your ability to dispute the chargeback.

Required Documentation Essentials

Maneuvering the representment process requires meticulous attention to detail, especially when it comes to gathering documentation. To effectively contest chargebacks, you'll need to compile thorough evidence that bolsters your case.

Start by organizing transaction records, which should include proof of delivery like tracking numbers and clear customer communication, such as emails or screenshots. These elements are essential for substantiating your claims against the chargeback reason codes. Additionally, understanding the importance of diversification in retirement portfolios can provide context for managing financial risks, including chargebacks.

Additionally, make sure to include authorization proof, including signed receipts and AVS/CVV checks. This documentation reinforces the legitimacy of the transaction, making your argument stronger during the representment process.

Crafting clear rebuttal letters tailored to specific chargeback reason codes is also vital. It shows you've addressed the cardholder's claims directly, enhancing your chances of winning disputes.

Adopting a systematic approach to collecting evidence won't only streamline your efforts but also greatly increase your chances of a successful representment. By understanding the documentation requirements based on chargeback reason codes, you can prepare more effectively and respond accurately, safeguarding your business against potential financial losses.

Common Dispute Challenges

Maneuvering the representment process can be challenging, particularly as you face various dispute challenges that arise from chargebacks. To effectively contest the chargeback, keep these common dispute challenges in mind:

- Fraud-Related Chargebacks: Many believe these can't be fought, but providing evidence of cyber shoplifting can help you win disputes.

- Chargeback Reason Codes: Each reason code requires a tailored, customized response. Generic answers often lead to low success rates.

- Evolving Disputes: Chargebacks can be re-classified with different reason codes, so continuous monitoring and adapting your strategies is essential.

Understanding these challenges is key to maneuvering the representment rights successfully.

Remember, acquirers may automatically contest certain chargebacks on your behalf, especially for unauthorized transactions or late processing claims. This can save you time and resources, allowing you to focus on crafting effective responses.

Best Practices for Chargeback Management

Effective chargeback management is essential for protecting your business's bottom line. To help merchants reduce chargebacks, start by implementing robust fraud detection tools that identify and prevent potential issues before they escalate into card disputes.

Regularly analyzing chargeback reason codes allows you to pinpoint recurring problems, enabling targeted improvements in customer service and transaction processes.

Clear communication with customers is fundamental. Make sure your return policies and product descriptions are straightforward to minimize misunderstandings, especially those related to friendly fraud. This proactive approach can greatly reduce chargebacks.

Proper documentation is another key factor. Maintain proof of delivery and transaction records, as this documentation is critical for disputing chargebacks effectively and increasing the odds of successful representment.

Frequently Asked Questions

What Are the Reason Codes in Chargeback?

Chargeback reason codes categorize transaction disputes, helping you identify issues. They vary by card network, covering areas like Fraud, Authorization Errors, or Processing Errors. Knowing these codes can greatly improve your dispute management strategies.

What Is a 13.5 Chargeback Reason Code?

You might think everything's smooth, but a 13.5 chargeback can hit hard. It signals merchandise wasn't received. Without solid proof of delivery, your chance to dispute it fades, risking lost sales and customer trust.

What Is the Reason for Chargeback Dispute?

Chargeback disputes typically arise when customers feel they've been wronged, whether due to unauthorized transactions or unsatisfactory products. You should address these concerns promptly to maintain trust and avoid further disputes in the future.

What Is R13 Chargeback Reason Code?

"An ounce of prevention's worth a pound of cure." The R13 chargeback reason code signals a "Credit Not Processed" issue, meaning you didn't issue a promised refund, leading to disputes. Keep records clear and communication open.

Conclusion

In the world of chargebacks, understanding reason codes is like holding the key to a locked door. By mastering this knowledge, you can navigate the complexities of disputes and safeguard your business. Think of each chargeback as a puzzle piece—when you fit them together, you reveal the bigger picture of customer satisfaction and financial health. Stay vigilant, adapt your strategies, and turn potential pitfalls into stepping stones for success. Your journey in chargeback management can lead to growth and resilience.