When developing a robust infrastructure for scalable payment processing, prioritize key components like payment gateways, databases, servers, and security measures for secure data flow. Design a scalable architecture on AWS using services like EC2, RDS, and Lambda, implementing secure workflows and payment gateway integration. Integrate reliable payment gateways such as Stripe and PayPal for real-time transaction settlement and multiple payment methods support. Strengthen security with encryption, tokenization, multi-factor authentication, and fraud detection. Thorough testing is vital; simulate peak traffic, stress test, and identify bottlenecks to guarantee system reliability. Prioritizing these components ensures a seamless and secure payment processing system.

Key Takeaways

- Utilize AWS services like EC2, RDS, and Lambda for scalable processing.

- Implement secure workflows and integrate reliable payment gateways.

- Ensure data security and compliance with regulations in architecture design.

- Prioritize real-time transaction settlement and support for multiple payment methods.

- Enhance security with encryption, tokenization, multi-factor authentication, and fraud detection.

Key Components for Payment Infrastructure

To build a robust payment infrastructure, you need to understand the key components that form its foundation. A secure payment infrastructure encompasses various elements like payment gateways, databases, servers, and stringent security measures. Ensuring the safety of sensitive payment data is paramount to prevent potential breaches and protect user information. Incorporating vital security protocols is essential to maintain the integrity of transactions and instill trust in your payment system.

Scalability is another critical aspect of payment infrastructure design. By considering scalability, you can effectively accommodate fluctuating transaction volumes without compromising the system's performance. This allows your payment infrastructure to grow seamlessly as your business expands, ensuring smooth operations even during peak times. Utilizing components like AWS services such as EC2, RDS, and Lambda can aid in creating a flexible and scalable payment environment that meets your evolving needs. Remember, a well-rounded payment infrastructure combines secure payment practices with scalability to deliver a reliable and efficient payment processing system.

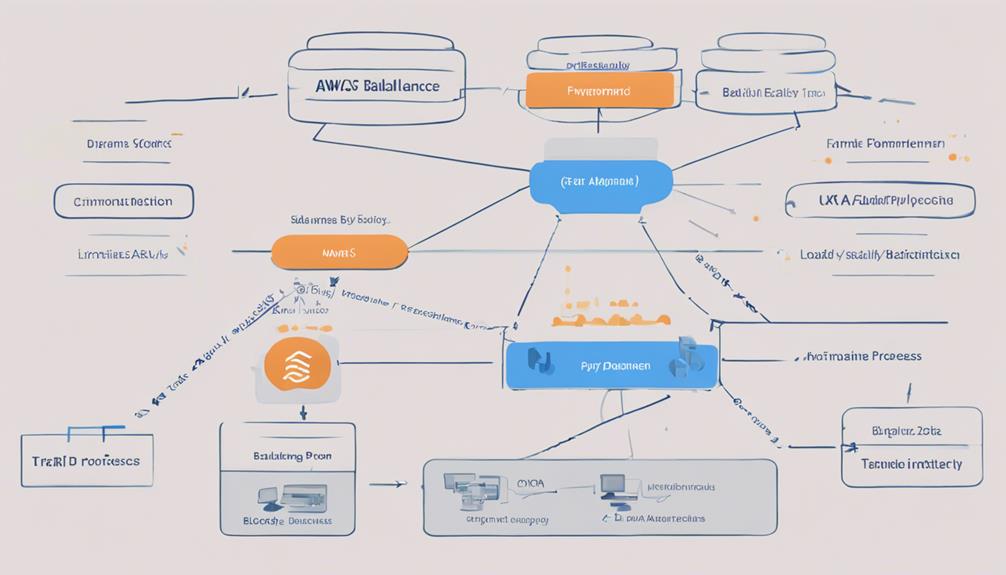

Designing Scalable Architecture on AWS

Incorporate AWS services like EC2, RDS, and Lambda to create a scalable infrastructure that efficiently handles varying transaction volumes while ensuring robust protection of sensitive payment data.

Designing a scalable architecture on AWS involves strategically utilizing these services to meet the dynamic demands of payment processing. By integrating secure workflows with chosen payment gateways, you can fortify the system against potential threats and safeguard valuable data.

Encryption of data, stringent access control measures, and continuous monitoring are crucial components for ensuring data security within the architecture. Thorough testing and post-deployment checks play a pivotal role in verifying the reliability and high availability of the payment processing system on AWS.

Adherence to compliance regulations such as PCI DSS is essential to maintaining data security while optimizing performance for efficient payment processing. Building a scalable architecture on AWS requires a meticulous approach that balances scalability, data security, and performance to create a robust infrastructure for seamless payment processing.

Integration of Reliable Payment Gateway

By seamlessly integrating a vital payment gateway, you can guarantee the secure transmission of sensitive financial data for efficient transaction processing. Payment gateways play an essential role in the payments infrastructure, enabling the seamless flow of funds between customers and merchants. These gateways, such as Stripe and PayPal, have the capability to process billions of transactions annually, showcasing their reliability and scalability in handling payment processing.

The integration of a payment gateway ensures that transactions are securely authorized and settled in real-time, providing a streamlined experience for both parties involved. Moreover, robust payment gateways support a variety of payment methods, including credit cards, digital wallets, and bank transfers, enhancing flexibility for customers.

Implementing Stringent Security Measures

Guarantee the vital protection of sensitive payment data by implementing stringent security measures. To enhance security, incorporate end-to-end encryption and tokenization protocols. These technologies ensure that payment information remains encrypted throughout the transaction process, safeguarding it from unauthorized access.

Additionally, implement multi-factor authentication and access controls to add layers of protection against potential breaches. By requiring multiple forms of verification, such as passwords, biometrics, or security tokens, you can greatly reduce the risk of unauthorized entry into payment systems.

Regularly conducting security audits and penetration testing is essential to identify and address vulnerabilities promptly. Compliance with Payment Card Industry Data Security Standard (PCI DSS) guidelines is also critical to ensure the secure handling of payment information.

Moreover, integrating fraud detection systems strengthens security measures by identifying suspicious activities and mitigating risks associated with fraudulent transactions. By prioritizing these security measures, you can establish a robust infrastructure that safeguards sensitive payment data effectively.

Thorough Testing for Payment Processing

To guarantee the robustness of your payment processing system, thoroughly test it by simulating peak traffic scenarios and evaluating its performance under extreme load conditions. Stress testing is vital to assess the system's capability under high volumes of transactions. By testing various payment scenarios, you can identify and address bottlenecks in the processing flow. Thorough testing not only covers security measures and compliance with regulations but also ensures overall system reliability.

Effective testing is essential to verify that the payment processing system can handle high volumes of transactions without compromising its performance.

- Simulate peak traffic scenarios

- Evaluate system performance under extreme load conditions

- Conduct stress testing to assess system capability

- Identify and address processing flow bottlenecks

- Ensure system reliability and security measures are in place

Frequently Asked Questions

What Is the Payment Processing Infrastructure?

Payment processing infrastructure encompasses components such as payment gateways, databases, servers, and security measures. It involves guaranteeing secure data transmission, transaction verification, and seamless communication among stakeholders.

Scalable infrastructure can flexibly handle transaction fluctuations and accommodate business expansion. Compliance with data security standards like PCI DSS is crucial to protect sensitive financial data.

A reliable and efficient setup guarantees smooth operations with minimal downtime, promoting high performance and customer satisfaction.

What Is an Example of a Scalable Infrastructure?

An example of a scalable infrastructure is a cloud-native architecture that leverages cloud technology for flexibility and scalability. This setup efficiently handles varying transaction volumes, ensuring smooth payment processing even during peak traffic.

Components like payment gateways, databases, servers, and security measures are essential for building a robust and scalable payment processing infrastructure. Such systems prioritize security, compliance with regulations, reliability, and performance optimization to meet the demands of modern payment processing needs.

How to Scale a Payment System?

To guarantee a payment system effectively, you implement horizontal scaling to distribute work efficiently across multiple instances.

Use containerization like Docker for enhanced scalability.

Optimize database queries and consider sharding for storage scaling.

Employ auto-scaling for varying volumes and address bottlenecks.

This approach guarantees seamless scalability in payment processing systems, offering a robust infrastructure that can handle increasing demands with ease.

How to Build Payment Systems?

When building payment systems, start by understanding the various steps involved, like user authentication and confirmation.

Prioritize scalability for smooth operations amid growth.

Consider non-functional requirements and performance benchmarks for efficient systems.

Integrating with third-party providers and meeting SLAs are essential.

Remember, each approval triggers fund transfers and notifications.

Keep these factors in mind for a robust payment infrastructure.

Conclusion

In summary, establishing a robust infrastructure for scalable payment processing is vital for businesses seeking efficiency and reliability. By incorporating key components, designing scalable architecture on AWS, integrating reliable payment gateways, implementing stringent security measures, and conducting thorough testing, organizations can guarantee seamless transactions and customer satisfaction.

Remember, success in payment processing lies in meticulous planning and execution. Stay vigilant, prioritize security, and pave the way for seamless financial transactions.