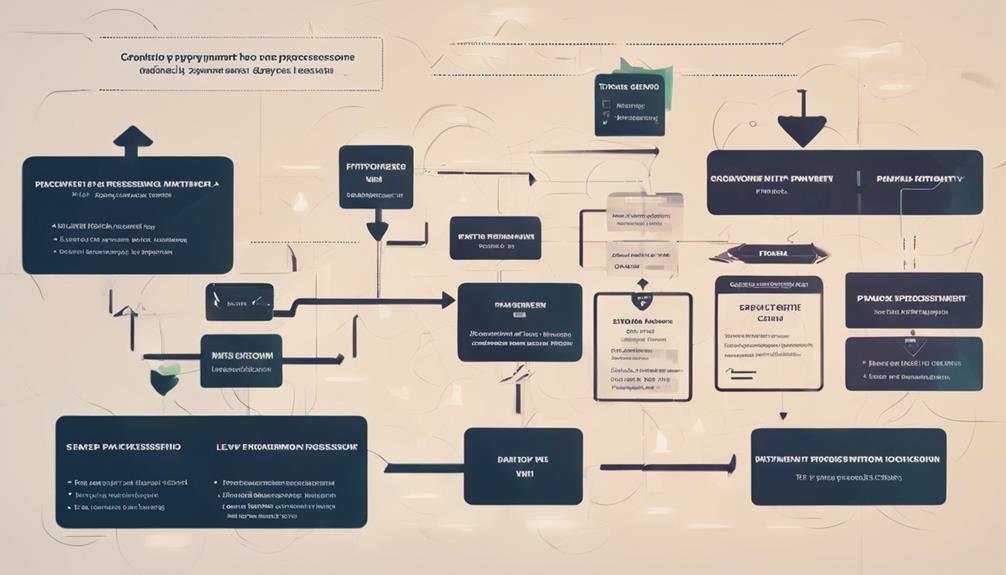

To access savings by mastering Level 3 payment processing, you need to meet specific requirements. Accept Visa or MasterCard corporate or government cards, provide detailed line-item information, and guarantee accuracy for approval. Level 3 cannot be used with physical terminals and must securely pass through a capable payment gateway. Different from Level 1 and 2, Level 3 involves almost twenty line-item fields and offers reduced interchange rates. Utilize Ebizcharge for streamlined processing and follow guidelines to avoid downgrades. Level 3 benefits include lower rates, enhanced fraud protection, and detailed insights for smarter decisions. Master Level 3 for top savings and security benefits. Mastering Level 3 payment processing can also lead to improved financial transaction processing times. By providing detailed line-item information, you can help streamline the reconciliation process for both you and your customers. This can ultimately lead to faster payment approvals and reduced lag time in receiving funds. Additionally, by utilizing a capable payment gateway and following Level 3 guidelines, you can ensure that your financial transaction processing times are optimized, leading to a smoother and more efficient overall payment experience. By understanding and abiding by bank cutoff times, you can ensure that your transactions are processed and settled in a timely manner. This can help you avoid potential delays in receiving funds and maintain a positive cash flow for your business. Following these guidelines and best practices will not only improve your financial transaction processing times, but also contribute to a more efficient and seamless payment process for both you and your customers. By understanding and abiding by bank cutoff times, you can ensure that your transactions are processed and settled in a timely manner. This can help you avoid potential delays in receiving funds and maintain a positive cash flow for your business. By staying informed about bank cutoff times and adhering to them, you can proactively manage your financial operations and minimize any potential disruptions to your cash flow. Additionally, being aware of bank cutoff times can help you plan and execute your payment processing activities more effectively, leading to greater efficiency and reliability in your financial transactions. Understanding and adhering to financial transaction cutoff times is essential for optimizing your business’s financial operations. By staying aware of these cutoff times, you can ensure that your payments are processed and settled efficiently, ultimately leading to improved cash flow management. Additionally, by following best practices for financial transaction cutoff times, you can minimize the risk of late or delayed payments, helping to maintain a positive relationship with your vendors and customers. Overall, staying informed and compliant with financial transaction cutoff times is crucial for the smooth and effective management of your business’s financial operations. Understanding bank cutoff times is not only crucial for efficient financial operations, but it also plays a key role in maintaining positive relationships with vendors and customers. By staying informed about these cutoff times and adhering to them, you can demonstrate reliability and professionalism in your payment processes. Furthermore, by understanding and implementing best practices for managing financial transaction cutoff times, you can position your business for long-term success and growth. By staying informed and compliant with financial transaction cutoff times, you can ensure that your payments are processed and settled efficiently, ultimately leading to improved cash flow management. Additionally, by following best practices for financial transaction cutoff times, you can minimize the risk of late or delayed payments, helping to maintain a positive relationship with your vendors and customers. Overall, staying informed and compliant with financial transaction cutoff times is crucial for the smooth and effective management of your business’s financial operations. Understanding financial transaction cutoff times is not only crucial for efficient financial operations, but it also plays a key role in maintaining positive relationships with vendors and customers. By staying informed about these cutoff times and adhering to them, you can demonstrate reliability and professionalism in your payment processes. Furthermore, by understanding and implementing best practices for managing financial transaction cutoff times, you can position your business for long-term success and growth. By staying informed and compliant with bank cutoff times, you can ensure that your payments are processed and settled efficiently, ultimately leading to improved cash flow management. Additionally, by following best practices for bank cutoff times, you can minimize the risk of late or delayed payments, helping to maintain a positive relationship with your vendors and customers. Overall, staying informed and compliant with bank cutoff times is crucial for the smooth and effective management of your business’s financial operations. Understanding and adhering to bank cutoff times is essential for optimizing your business’s financial operations. By staying aware of these cutoff times, you can ensure that your payments are processed and settled efficiently, ultimately leading to improved cash flow management. Additionally, by following best practices for bank cutoff times, you can minimize the risk of late or delayed payments, helping to maintain a positive relationship with your vendors and customers. Overall, staying informed and compliant with bank cutoff times is crucial for the smooth and effective management of your business’s financial operations. By managing your financial transactions in accordance with bank cutoff times, you can enhance the efficiency and reliability of your payment processes while maintaining strong relationships with your stakeholders.

Key Takeaways

- Level 3 processing offers lower interchange rates for detailed transaction data.

- Enhanced fraud protection with additional data fields in Level 3 processing.

- Detailed transaction data provides better financial insights and cost savings.

- Preauthorization for future charges helps in smooth processing and avoids downgrade risk.

- Integration with ERP systems streamlines payment processing for Level 3 requirements.

Achieving Level 3 Processing Requirements

Wondering how to meet the requirements for achieving Level 3 processing efficiently?

To achieve Level 3 processing, merchants must make sure they accept purchasing cards, corporate cards, or government spending accounts issued by Visa or MasterCard. This level of processing is vital for accepting GSA cards.

Unlike Level 1 processing, Level 3 requires sending nearly twenty fields of line-item detail. It goes beyond the standard transaction details of Level 1 and the sales tax inclusion of Level 2. Remember, missing even one detail can disqualify a transaction from Level 3 status.

Correct data, card type approval, and bank approval are essential for successful Level 3 transactions. Keep these requirements in mind to access the benefits of Level 3 processing efficiently.

Level 3 Processing Exclusions

While Level 3 processing offers various advantages, it's important to note the exclusions that come with it. Here are some key points to keep in mind:

- Level 3 processing can't be used with physical terminals.

- Data must be securely passed to a capable payment gateway for Level 3 transactions.

- Missing even one detail disqualifies a transaction for Level 3.

- Correct data and card type approval are essential prerequisites for Level 3 processing.

Understanding these exclusions will help you navigate the requirements of Level 3 processing more effectively and make sure that your transactions meet the necessary criteria for optimal savings and efficiency.

Level 3 Vs. Other Levels

When comparing Level 3 processing to other levels, it's important to understand the distinct requirements and benefits each level offers.

Level 1 processing involves standard transaction details, while Level 2 adds the requirement of sales tax.

Level 3 processing stands out by necessitating nearly twenty fields of line-item detail for transactions. Unlike Level 1 and Level 2, Level 3 pricing is vital for accepting GSA cards.

Additionally, Level 3 processing offers reduced interchange rates compared to other levels, making it a cost-effective choice for businesses dealing with corporate or government transactions.

Understanding these differences can help you determine the best processing level for your specific business needs.

Getting Level 3 With Ebizcharge

To achieve Level 3 processing with EBizCharge, integrate your data from ERP systems for streamlined payment processing. This integration allows for efficient handling of transactions and ensures that you meet Level 3 processing requirements.

Here are four key points to keep in mind:

- Preauthorization: Utilize this feature to hold funds for future charges, adding flexibility to your payment processing.

- Downgrade Risk: Violating rules may result in a downgrade to standard processing, so it's important to adhere to guidelines.

- Matching Funds: Make sure that captured funds match or are less than the preauthorization amount to avoid discrepancies.

- Timing Matters: Capturing funds within a few days of preauthorization is essential for smooth transaction processing.

Benefits of Level 3 Processing

To fully capitalize on Level 3 processing advantages, you must understand the inherent benefits it offers your payment transactions. Level 3 processing provides detailed transaction information that can lead to significant cost savings for your business. Here are some key benefits of Level 3 processing:

| Benefits | Description | Impact |

|---|---|---|

| Lower Interchange Rates | Detailed transaction data qualifies for lower interchange rates. | Cost savings |

| In-depth Reporting | Access to thorough transaction details for better financial insights. | Improved decision-making |

| Increased Security | Additional data fields provide enhanced fraud protection. | Reduced risk |

Frequently Asked Questions

Can Level 3 Processing Be Achieved Without Visa or Mastercard Acceptance?

Level 3 processing can't be achieved without accepting Visa or MasterCard. To reach Level 3 pricing, merchants must be able to process purchasing cards, corporate cards, or government spending accounts issued by these major card networks.

This requirement is essential, especially for accepting GSA cards. Without Visa or MasterCard acceptance, achieving Level 3 processing isn't possible. Make sure you have the necessary card types approved to access Level 3 benefits.

Are There Any Penalties for Failing to Capture Funds Within the Required Timeframe in Level 3 Processing?

If you fail to capture funds within the required timeframe in Level 3 processing, penalties may occur.

Not capturing funds promptly can result in a downgrade to standard processing.

It's important to match or capture funds below the preauthorization amount and do so within a few days.

Adhering to these guidelines is essential for maintaining Level 3 processing privileges and avoiding potential penalties.

Is There a Limit to the Number of Preauthorizations That Can Be Held at Once With Ebizcharge for Level 3 Processing?

When using EBizCharge for Level 3 processing, it's crucial to verify that the capture funds match or are less than the preauthorization amount and are processed within the required timeframe.

This feature allows for flexibility in managing funds for future charges efficiently.

This capability enhances your payment processing experience and helps streamline financial operations effectively without any discrepancies.

What Happens if a Merchant Accidentally Captures More Funds Than Initially Preauthorized in Level 3 Processing?

If you accidentally capture more funds than initially preauthorized in Level 3 processing, it can lead to non-compliance and possible downgrade to standard processing. To avoid issues, guarantee that the captured funds match or are less than the preauthorized amount.

Capturing funds promptly within the specified timeframe is essential for maintaining Level 3 status. Violating rules can have serious consequences, so always double-check your transactions to prevent over-capturing funds.

Are There Any Restrictions on the Types of Products or Services That Can Be Processed Using Level 3 Processing?

There are no specific restrictions on the types of products or services that can be processed using Level 3 processing. As long as the transaction details meet the requirements set by Visa and MasterCard, you can process a wide range of products or services.

Conclusion

Accessing Level 3 payment processing is like discovering the key to a treasure trove of savings. By meeting the requirements and understanding the differences between processing levels, you can access reduced interchange rates and accept a wider range of cards.

With EBizCharge's streamlined integration and preauthorization capabilities, you can navigate Level 3 processing with ease. Maximize your payment efficiency and avoid downgrades by staying informed and mastering Level 3 transactions.

Get ready to access significant savings and optimize your payment processing today.