Starting & Managing Payment Services

Start Your Payment Gateway Business: A Step-By-Step Guide

Master the art of launching a payment gateway business with expert guidance and essential steps.

To start your payment gateway business, begin with thorough market research to understand industry trends and identify competitors. Develop a strategic plan to map growth and tailor your gateway infrastructure to market needs. Outline key features, create secure payment processes, and establish project milestones. Guarantee seamless integration, conduct rigorous testing, and obtain necessary certifications for compliance. Choose the right deployment strategy, prioritize security, and maintain your system rigorously. Provide customizable solutions, specialized payment methods, and round-the-clock support services for clients. Implement robust security measures following industry standards. Following these steps will set you on the path to a successful payment gateway business.

Key Takeaways

- Conduct in-depth market research to understand industry trends and customer preferences.

- Develop a strategic plan for growth, analyzing market trends, and tailoring payment infrastructure.

- Integrate, test, and ensure compliance with certifications like PCI DSS and ISO 27001.

- Deploy securely, prioritize scalability, and maintain systems with regular audits and updates.

- Provide customizable solutions, 24/7 support, and robust security measures like encryption and tokenization.

Market Research for Industry Understanding

Conduct thorough market research to gain a deep understanding of the payment gateway industry. By delving into market research, you can uncover important industry trends, identify competitors, and grasp customer preferences.

Understanding regulatory requirements and compliance standards is essential for ensuring your business meets legal obligations when entering the market. Explore pricing strategies to determine the most competitive approach for your payment gateway services.

Market research not only sheds light on industry dynamics but also guides product positioning and marketing strategies. Analyzing market data will help you identify opportunities for growth while being aware of potential challenges that may lie ahead.

Strategic Planning for Business Development

To chart a successful course for your payment gateway business, strategic planning is essential to map out the path for growth and achievement. Strategic planning involves setting goals, identifying resources, and outlining strategies to guarantee your business's success.

By analyzing market trends, competition, and customer needs, you can tailor your payment gateway infrastructure to provide a reliable and secure payment processing solution. This tailored approach will help you adapt to changing market dynamics and stay ahead of the competition.

Strategic planning also aids in allocating resources effectively, ensuring that you make informed decisions that align with your long-term objectives. Keep a close eye on market trends to anticipate shifts in the industry and tailor your offerings to meet the evolving needs of customers.

Design and Development Phases Overview

When designing and developing your payment gateway, it's important to outline key features and define project requirements clearly.

This stage involves creating user interfaces, workflows, and system architecture to guarantee a seamless user experience.

Outline Key Features

What key features should you prioritize when outlining the design and development phases of a payment gateway business?

Customization options, compliance with industry standards, scalability, and secure payment processes are important aspects to take into account.

Here are the key features to focus on:

- Customization Options: Guarantee your payment gateway can be tailored to meet specific business needs.

- Compliance: Adhere to industry standards like PCI DSS to ensure data security.

- Scalability: Plan for growth by designing a system that can handle increased transaction volumes.

- Secure Payment: Implement robust security protocols to safeguard payment transactions and customer data.

Define Project Requirements

Define the project requirements clearly to establish the foundational framework for the design and development phases of your payment gateway business. Specify the features, functionalities, and integrations necessary for the payment gateway. Determine the technology stack, security measures, and compliance requirements essential for a robust system.

Create a detailed project plan with milestones and timelines for each phase to guarantee a structured approach. Align the project requirements with your business objectives, user needs, and industry standards during the design and development stages.

Integration and Testing Process

In order to guarantee the smooth operation of your payment gateway system, the integration and testing process is a critical step that involves connecting the gateway to your merchant's website or application. To ensure a reliable and efficient payment gateway, follow these steps:

- Integration: Connect your payment gateway to the merchant systems to enable transactions seamlessly.

- Testing: Conduct thorough testing to guarantee effective communication between the gateway, processor, and merchant systems.

- Compatibility: Test compatibility across various devices and browsers to ensure smooth transactions for all users.

- Security: Perform security testing to identify and address vulnerabilities, ensuring data protection during transactions.

Efficient integration and testing processes are key to the success of your payment gateway. By prioritizing compatibility, security, and effective communication, you can establish a robust system that instills trust in your merchants and customers alike.

Compliance Certifications Acquisition

To guarantee the regulatory adherence and credibility of your payment gateway business, acquiring compliance certifications is vital. Start by obtaining PCI DSS certification to comply with industry security standards, ensuring the secure processing of transactions.

Additionally, acquiring EMV certification is essential for processing chip-enabled cards securely, enhancing customer trust in your services. ISO 27001 certification for information security management further solidifies your commitment to safeguarding sensitive data.

To prevent money laundering activities and adhere to regulations, secure AML compliance certification. Don't forget to obtain the necessary licenses and certifications to operate legally in your target markets, ensuring a smooth entry into new regions.

Deployment Strategies for Success

Consider key factors such as scalability, security, and integration capabilities when selecting the appropriate deployment strategy for your payment gateway business to guarantee its success.

To guarantee a successful deployment, follow these key steps:

- Choose Wisely: Select the right deployment strategy based on your business model and target market.

- Prioritize Security: Guarantee that your deployment strategy prioritizes security to safeguard sensitive payment data.

- Emphasize Scalability: Opt for a deployment approach that allows for scalability as your business grows.

- Evaluate Integration Capabilities: Assess the integration capabilities of your deployment strategy to seamlessly connect with other systems.

Ongoing Maintenance for Sustainability

Guarantee the sustainability of your payment gateway business by proactively maintaining security measures and conducting regular audits to stay compliant with industry standards. Keep your system secure by updating security measures to combat evolving threats effectively.

Regular compliance audits are essential to make sure that your business meets industry standards and regulations. Implementing software updates and patches is vital for maintaining system functionality and protecting against vulnerabilities.

Monitor transactions regularly to identify any anomalies or suspicious activities, which could indicate potential security breaches. Additionally, provide staff training on best practices for handling sensitive payment information to reduce the risk of security incidents.

Offering Customizable Solutions

Enhance your payment gateway business by providing customizable solutions tailored to meet the unique needs of your clients. These custom payment gateways offer a personalized experience and flexible design, ensuring a seamless user experience.

Here are four key ways customizable solutions can benefit your business:

- Tailor Payment Gateways: Customize features, integrations, and designs to align with your clients' specific requirements.

- Unique Payment Methods: Offer specialized payment methods to cater to diverse customer preferences and industry standards.

- Specialized Reporting: Provide detailed and customized reporting options for better insights into transaction data and trends.

- Enhanced User Experience: Customize the checkout process and payment flow to optimize user interaction and satisfaction.

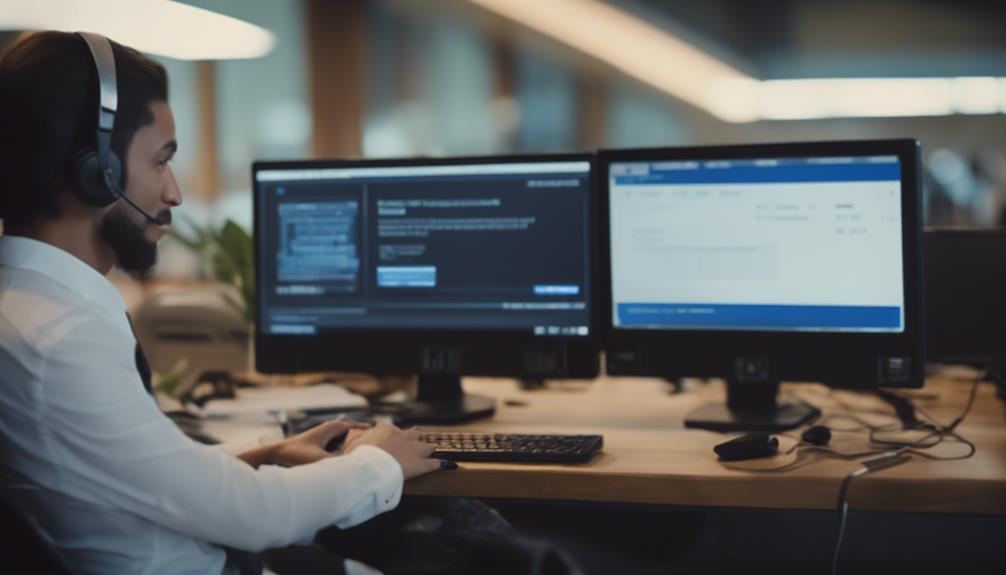

Providing Reliable Support Services

To guarantee seamless operations and customer satisfaction, prioritize providing round-the-clock support services for technical assistance and payment inquiries. Make sure your support team is well-trained to handle complex payment gateway issues promptly. Offer various communication channels such as phone, email, and live chat for the convenience of your customers. Implement a ticketing system to effectively track and prioritize customer queries, ensuring timely resolutions. Regularly gather feedback from customers to identify areas for improvement in your support services. By focusing on customer support, you can build trust with your clients and establish a reputation for reliability in the payment gateway industry.

| Support Services | Key Points |

|---|---|

| Customer Support | 24/7 availability |

| Communication Channels | Phone, email, live chat |

| Training | Handling complex issues |

| Ticketing System | Effective query tracking |

| Feedback | Continuous improvements |

Implementing Robust Security Measures

Prioritize the implementation of robust security measures in your payment gateway business by emphasizing encryption protocols like SSL/TLS to safeguard payment data. To guarantee the highest level of security, follow these key steps:

- Implement encryption protocols: Utilize SSL/TLS to encrypt sensitive data during transmission, preventing unauthorized access.

- Utilize tokenization: Replace sensitive information with unique tokens to add an extra layer of security and protect customer data.

- Regular security audits and penetration testing: Conduct routine checks to identify vulnerabilities and proactively address security concerns.

- Comply with industry standards: Adhere to regulations like PCI DSS to maintain secure payment processing systems and protect against cyber threats.

Frequently Asked Questions

How Do I Start My Own Payment Gateway?

To start your own payment gateway, research market demand, competition, and opportunities. Develop a business plan with a target market, unique selling proposition, pricing, and operations.

Obtain necessary licenses, permits, and certifications for compliance and customer trust. Choose a reliable technology partner or payment processor for technical aspects.

Implement strong security measures, encryption, and fraud prevention tools for transaction and data safety.

What Are the Steps of Payment Gateway?

To set up a payment gateway, you'll need to follow a series of steps akin to constructing a sturdy bridge.

Start by researching your market and competition, then design and develop a user-friendly interface and infrastructure.

Test rigorously for security and compatibility.

Obtain necessary certifications like PCI DSS for compliance.

Once ready, deploy your gateway and guarantee smooth operations for satisfied customers.

How Do I Start a Payment Processing Company?

To start a payment processing company, research local laws for licensing requirements. Obtain necessary certificates to comply with regulations and boost credibility. Prioritize meeting standards like PCI DSS for trust and authority.

Consider using a white label solution to expand your market reach and simplify licensing. Understanding the significance of licensing and compliance is key to launching your payment processing business successfully.

How Long Does It Take to Build a Payment Gateway?

Building a payment gateway typically takes 6 to 12 months based on complexity and features. The process involves planning, design, integration, testing, compliance, and deployment.

Customization, security, and certifications can affect timing. Thorough testing guarantees security and efficiency. Team expertise, resources, and regulations also influence the timeline.

It's essential to handle each stage meticulously to create a reliable payment gateway.

What are the essentials steps to start a payment gateway business and how does it differ from setting up a merchant account for accepting payments?

To start a payment gateway business, the first steps to accept payments include conducting market research, obtaining necessary licenses, and developing a secure platform. Setting up a merchant account for accepting payments is different in that it involves creating a direct relationship with a financial institution for processing transactions.

Conclusion

To sum up, embarking on a payment gateway business necessitates comprehensive market research, strategic planning, design and development phases, integration and testing, compliance certifications, ongoing maintenance, customizable solutions, reliable support services, and robust security measures.

One interesting statistic to note is that the global digital payment market is projected to reach $10.07 trillion by 2026, highlighting the immense potential for growth and success in this industry.

By following these steps and staying committed to excellence, you can establish a thriving payment gateway business.

Starting & Managing Payment Services

Distribution Businesses Rave About Innovative Payment Solutions

Get ready to revolutionize your payment processes with innovative solutions that distribution businesses can't stop talking about.

Distribution businesses love innovative payment solutions for their user-friendly features, seamless integration, transparent fee structures, extensive accounting integrations, and exceptional ratings. Customized features cater to distribution operations, ensuring enhanced security, simplified billing, and increased efficiency. Reliable support systems with robust tech partnerships, PCI-compliant security, and high uptime guarantee smooth operations. The widespread adoption of these solutions speaks volumes about their effectiveness in streamlining payment processes and optimizing business performance. Discover more about why these solutions are becoming the go-to choice for distribution businesses.

Key Takeaways

- Enhanced security features for safe transactions.

- Simplified billing processes for efficiency.

- Robust support systems for reliable assistance.

- Seamless integration with existing distribution operations.

- PCI-compliant security measures for data protection.

Reasons Why Distribution Businesses Choose Innovative Payment Solutions

If you're a distribution business looking for a reliable payment solution that offers user-friendly features and seamless integration, Innovative Payment Solutions is the perfect choice for you.

With no contracts and $0 hidden fees, you can trust in a service that values transparency. The 100+ accounting integrations guarantee smooth operations, while the unlimited support guarantees assistance whenever you need it. Innovative Payment Solutions is renowned for its 4.8 out of 5-star rating, reflecting the trust and satisfaction of other businesses like yours.

Key Features Tailored for Distribution Businesses

Discover the tailored key features designed specifically to enhance the operations of distribution businesses.

- Seamless Integration: Easily integrates into popular distribution tools for a smooth user experience.

- Enhanced Security: Reduces security liability and guarantees safe card-not-present transactions.

- Simplified Billing: Automatically collects variable payment amounts at the end of each billing cycle for convenience and efficiency.

Support and Reliability for Seamless Operations

For seamless operations, rely on our robust support system and unwavering reliability. With 400+ tech and business partners, including PCI-compliant security measures and dispute management, we guarantee your business runs smoothly. Our unlimited support is there for you whenever you need assistance, making sure that any issues are resolved promptly.

Enjoy a 99.9% uptime, providing you with the confidence that our system is always available when you need it. Easy setup and no contracts make it hassle-free to get started with our service, giving you peace of mind for the long term. Trust in our support and reliability to keep your operations running seamlessly day in and day out.

Frequently Asked Questions

Can I Integrate With My Existing Accounting Software?

Yes, you can integrate our service with your existing accounting software. Get a demo to see how it works seamlessly with over 100 accounting integrations.

There are no contracts or hidden fees, and you'll have access to unlimited support. Our user-friendly system is easy to implement and can process card-not-present transactions efficiently, reducing security liabilities.

Trust our 4.8-star reputation and contact sales for more information on our innovative payment solutions.

Is There a Fee for Using the Payment Portal?

Yes, there's a fee for using the payment portal. It offers a range of features such as user-friendly interface, easy implementation, and compatibility with popular distribution tools.

The fee structure is transparent, with no hidden costs. You can access unlimited support and benefit from reduced security liability.

The portal is perfect for card-not-present transactions. Contact sales to learn more about the fee details and how the payment portal can enhance your business operations.

How Quickly Can I Set up the Virtual Terminal?

You can set up the virtual terminal quickly. The process is straightforward and user-friendly. You'll find it easy to navigate and implement within your business operations.

The virtual terminal works efficiently for card-not-present transactions, reducing security risks. Additionally, it seamlessly integrates with popular distribution tools. This solution enhances your payment processing capabilities and provides a secure platform for managing transactions.

What Kind of Security Measures Are in Place?

When it comes to security measures, our system has you covered. We've implemented high-quality PCI-compliant protocols to safeguard your transactions.

Additionally, our dispute management system guarantees any issues are promptly addressed. With a track record of 99.9% uptime and a network of 400+ tech partners, you can trust in our reliability.

Rest assured, your payments are in safe hands with our robust security features.

Do You Offer Training for Using the Payment Solutions?

Yes, training is available for using the payment solutions. You can access a demo to learn about the features, such as user-friendly interfaces and easy implementation.

The service integrates with popular distribution tools and is ideal for card-not-present transactions. Training helps minimize security liability and guarantees efficiency in payment processing.

With unlimited support, you can navigate the system confidently. Contact sales to get started with the training process.

Conclusion

To sum up, distribution businesses are selecting our innovative payment solution for its unmatched convenience, flexibility, and reliability.

While some may worry about the switch process, our seamless integration and unlimited support guarantee a smooth implementation.

With over 100 accounting integrations and PCI-compliant security, our platform is designed to streamline operations and drive growth.

Trust in our 4.8 out of 5-star reputation and experience the efficiency of payment processing like never before.

Starting & Managing Payment Services

Efficient Payment Solutions for Transportation Businesses

Wishing to streamline payment processes in transportation? Discover key features for efficient solutions that will elevate your business.

For efficient payment solutions in transportation, opt for features like seamless integration, secure transactions, and user-friendly interfaces. Look for options with no hidden fees, unlimited support, and mobile payment capabilities. Trusted systems with solid reputations and proven track records are key. Features to enhance efficiency include secure payment options, integrated software transactions, and customizable payment portals. Seek partnerships with reputable entities for widespread coverage and reliable service. Simplify payment processes, focus on growth, and prioritize client satisfaction. Discover more about optimizing payment solutions for your transportation business.

Key Takeaways

- Seamless integration with popular accounting tools for efficient payment processing.

- Mobile app available for on-the-go payments, enhancing convenience for transportation businesses.

- Secure payment options ensure transaction safety and build trust with clients.

- Partnered with 400+ entities for widespread coverage and reliable payment processing.

- 99.9% uptime and PCI-compliant security ensure stable and efficient payment solutions.

Key Reasons for Choosing Payment Solutions

When selecting a payment solution for your transportation business, prioritize features that align with your accounting needs and guarantee smooth integration with your existing tools. This guarantees efficiency and streamlines your financial processes.

Look for a solution with 100+ accounting integrations, no contracts, $0 hidden fees, unlimited support, and a user-friendly interface. These features can make managing payments easier and more convenient for you.

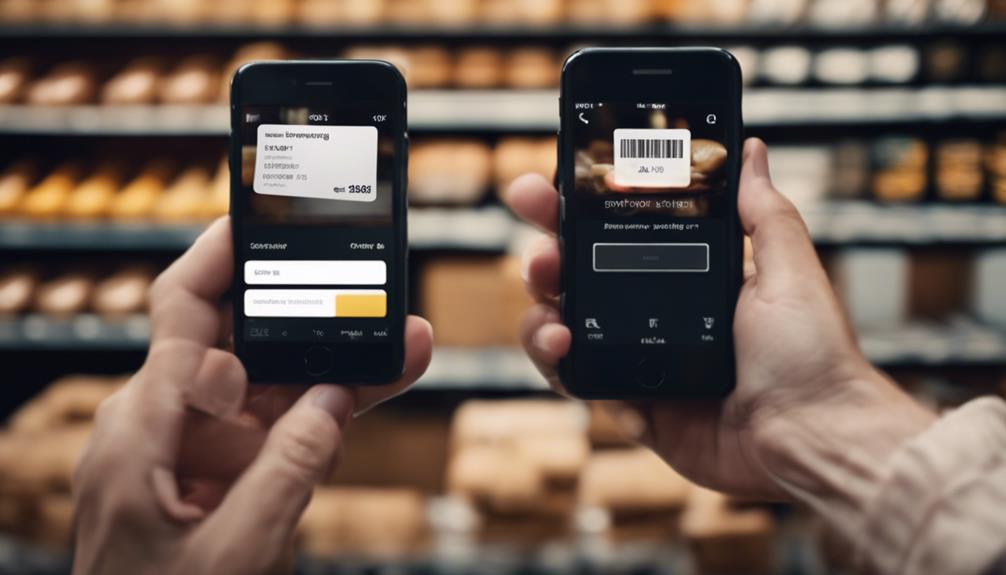

Benefits for Transportation Businesses

Maximize the efficiency of your transportation business with the numerous benefits offered by our payment processing solution. Enjoy easy implementation and seamless integration with popular reservation, ERP, and CRM tools. Our system directly integrates with over 100 ERP, accounting, eCommerce, and POS systems, allowing for a smooth payment process.

You can also utilize our mobile app for on-the-go payments, ensuring convenience for both you and your customers. Enhanced security features are in place to reduce fraud risks, providing peace of mind during transactions. With our payment solution, you can streamline your payment processes and focus on growing your transportation business with confidence.

Trust and Reputation Factors

To establish trust and credibility in the transportation industry, prioritize exploring the payment solution's extensive user base and exceptional ratings. By choosing a payment processor with a proven track record and positive reviews from a wide range of users, you can reassure your customers and partners of your commitment to reliable transactions.

A high number of satisfied users and consistently high ratings, such as between 4.8 to 4.6 out of 5 stars, indicate a service that's dependable and efficient. Contact sales for more information on how this payment solution can enhance your transportation business's reputation and instill confidence in your payment processes.

Trust and reputation play a significant role in building lasting relationships and attracting new clients in the competitive transportation industry.

Features Enhancing Payment Efficiency

To streamline your payment processes and enhance efficiency, explore the array of features offered by this payment solution tailored for transportation businesses. This solution provides quick, easy, and secure payment options for your customers, ensuring a seamless transaction experience.

You can run transactions inside 100+ popular business software, send payment links for one-time payments, and utilize a payment portal for repeat customers. Additionally, you can automatically collect variable payment amounts and turn any web browser into a payment processor with a virtual terminal.

With these capabilities, you can expedite payments and improve the overall efficiency of your payment processes, ultimately enhancing the service you provide to your clients.

Partnerships and Coverage Details

Partnering with over 400 tech and business entities, our payment solution guarantees widespread coverage and seamless integration for transportation businesses.

When considering partnerships and coverage details, keep in mind:

- Explore Opportunities: Discover potential collaborations to enhance your payment processes.

- PCI-Compliant Security: Guarantee your transactions are secure and protected.

- Dispute Management: Handle payment conflicts efficiently and professionally.

- 99.9% Uptime: Rely on a stable and consistent payment system for your business needs.

Frequently Asked Questions

Can I Customize the Payment Options for My Transportation Business?

Yes, you can easily customize payment options for your transportation business.

The solution offers various features like quick, secure payment options, payment links for one-time payments, a payment portal for repeat customers, and the ability to collect variable payment amounts automatically.

You can also turn any web browser into a payment processor with a virtual terminal.

Feel free to explore a demo to understand these customizable options better.

How Quickly Can I Start Using the Mobile App for Payments?

You can start using the mobile app for payments quickly. It offers a streamlined process to accept payments on the go. Simply download the app, create an account, and follow the easy setup instructions.

Once you're set up, you can begin processing payments efficiently and securely anytime, anywhere. The mobile app provides convenience and flexibility for your transportation business's payment needs.

Are There Any Additional Costs for Dispute Management Services?

There are no additional costs for dispute management services. All dispute management features are included in your payment processing solution.

With these services, you can handle disputes efficiently and effectively without incurring any extra charges. This guarantees that you can manage any payment conflicts that arise without worrying about unexpected expenses.

If you have further questions about dispute management, feel free to reach out for more information.

Can I Integrate the Payment Portal With My Current CRM System?

Yes, you can integrate the payment portal with your current CRM system. This seamless integration allows for efficient payment processing within your existing platform, streamlining your operations and enhancing customer experience.

By linking the payment portal with your CRM system, you can easily manage transactions, track customer payments, and improve overall efficiency in handling financial transactions.

Contact our team for more details on how to set up this integration.

Is There a Limit to the Number of Payment Links I Can Send Out?

There's no limit to the number of payment links you can send out. You have the flexibility to send as many payment links as needed to accommodate your business transactions.

This feature allows you to efficiently collect payments from multiple customers without any restrictions. Whether it's one-time payments or recurring transactions, you can easily manage your payment process by sending out payment links as required.

Conclusion

To sum up, by selecting our efficient payment solutions for transportation businesses, you're providing your company with the tools needed to streamline transactions and enhance customer satisfaction.

With our trusted reputation, user-friendly features, and strong partnerships, you can be confident that your payment processing needs will be met with reliability and security.

Elevate your business to new heights with our cutting-edge solution and experience the benefits of seamless integration and enhanced efficiency.

Starting & Managing Payment Services

Government Agencies Rave About Payment Processing Solutions

Come see why government agencies are raving about payment processing solutions, promising unparalleled efficiency and revolutionizing financial operations.

Government agencies nationwide are lauding payment processing solutions for their unparalleled efficiency in revolutionizing financial operations. These solutions excel in streamlining processes, offering user-friendly interfaces, ensuring rapid and secure transactions, and boasting easy setup. Loved features include seamless accounting integration, no lengthy contracts, zero hidden fees, unlimited support, and intuitive interfaces. Testimonials showcase remarkable results: the Department of Finance experienced a 30% speed boost, the Ministry of Transportation saw a 25% error decrease, and the Social Services Agency achieved a 40% reduction in manual tasks. The Department of Health praises the robust security measures. Discover more benefits by exploring further.

Key Takeaways

- Streamlined payment processing boosts efficiency for government agencies.

- User-friendly interfaces ensure quick and secure transactions.

- Seamless integration with existing accounting systems for hassle-free experience.

- PCI-compliant security measures provide peace of mind.

- Testimonials showcase significant improvements in speed, accuracy, and manual task reduction.

Benefits of Payment Processing Solutions for Government Agencies

When streamlining payment processing for government agencies, you'll experience the benefits firsthand with our efficient and user-friendly solutions. Our system guarantees quick and secure transactions, enabling you to receive payments faster than ever before.

With a seamless setup process and unlimited support, you can trust that any issues will be promptly addressed. Our solutions are designed to integrate smoothly with existing accounting systems, providing a hassle-free experience for your agency.

Enjoy the peace of mind that comes with PCI-compliant security measures and reliable uptime, allowing you to focus on your core responsibilities without worrying about payment processing. Simplify your financial processes and enhance efficiency with our trusted payment solutions tailored for government agencies.

Features That Government Agencies Love

Government agencies appreciate the array of features our payment processing solutions offer, enhancing their efficiency and security in handling transactions. Here are some key features that government agencies love:

| Features | Description | Benefits |

|---|---|---|

| Accounting Integrations | Seamlessly integrate with 100+ accounting systems | Streamlined financial processes |

| No Contracts | No long-term commitments or obligations | Flexibility in service usage |

| $0 Hidden Fees | Transparent pricing with no hidden charges | Budget-friendly transactions |

| Unlimited Support | Access to round-the-clock customer assistance | Quick resolution of issues |

| User-friendly | Intuitive and easy-to-navigate interface | Simplified payment processing |

Testimonials From Government Agencies

With praises echoing from various government agencies, our payment processing solutions have proven indispensable in streamlining operations and boosting efficiency.

- The Department of Finance reported a 30% increase in payment processing speed since adopting our solution.

- The Ministry of Transportation highlighted a 25% reduction in errors and a significant improvement in revenue collection accuracy.

- The Social Services Agency commended the seamless integration with their existing systems, leading to a 40% decrease in manual data entry.

- The Department of Health emphasized the robust security features that guaranteed compliance with stringent data protection regulations.

Frequently Asked Questions

Can Government Agencies Customize Their Payment Processing Solutions?

Yes, government agencies can customize their payment processing solutions. With over 100 accounting integrations, no contracts, and user-friendly features, customization is easy.

Give customers quick, secure payment options to get paid faster. From email pay to mobile pay, our solutions cater to unique agency needs.

Enjoy PCI-compliant security, dispute management, and unlimited support for a seamless payment experience. Stand out with tailored solutions that fit your agency's requirements perfectly.

Are There Any Special Discounts Available for Government Organizations?

You might be wondering about special discounts for government organizations.

While specific discounts aren't mentioned here, the platform does offer benefits like no contracts, $0 hidden fees, and unlimited support.

This could be advantageous for government agencies looking for flexible payment processing solutions.

If you're interested, reaching out to the sales team could provide more insights tailored to your organization's needs.

How Quickly Can Government Agencies Set up Their Payment Processing?

When setting up payment processing, government agencies can do so quickly with our user-friendly system. Enjoy the benefits of easy integration, no contracts, and transparent pricing with zero hidden fees.

Our support team is always available to assist you, ensuring a smooth process. By providing secure and efficient payment options, you can start receiving payments faster. Trust our reliable service with a track record of satisfied users and excellent reviews.

Is There a Limit to the Number of Transactions Government Agencies Can Process?

There's no limit to the number of transactions government agencies can process. You have the freedom to manage as many transactions as needed efficiently. Our system is designed to handle high volumes seamlessly, ensuring smooth operations for your agency.

Focus on your tasks without worrying about transaction limits. We provide the flexibility you require for your payment processing needs, empowering you to streamline your financial operations effectively.

Are There Any Additional Fees for Integration With Accounting Software?

When integrating with accounting software, you won't encounter any additional fees with our service. Rest assured, our smooth process guarantees a hassle-free experience.

You can enjoy a user-friendly interface and quick setup without hidden costs. Focus on streamlining your payments without worrying about extra charges.

Join the many satisfied users who appreciate our transparent approach to payment processing solutions.

Conclusion

To sum up, government agencies find our payment processing solutions to be as dependable as a well-oiled machine.

With seamless integration, excellent security, and unparalleled support, it's no surprise why over 400,000 users trust us.

Join our network of satisfied customers and experience the efficiency and ease of our platform today.

Don't settle for complicated systems and hidden fees – choose a solution that works for you.

-

Credit Card Processing & ISOs3 months ago

Credit Card Processing & ISOs3 months agoThe Role of a Registered ISO at a Bank

-

Starting & Managing Payment Services2 months ago

Starting & Managing Payment Services2 months agoNavigating Chargeback Disputes: Key Considerations for Merchants

-

Starting & Managing Payment Services3 months ago

Starting & Managing Payment Services3 months agoIntegrating and Managing Multiple Payment Solutions Effectively

-

Starting & Managing Payment Services3 months ago

Starting & Managing Payment Services3 months agoAccounts Payable Vs. Accounts Receivable Unveiled

-

Starting & Managing Payment Services3 months ago

Starting & Managing Payment Services3 months agoHow to Manage Compliance Risks in Payment Services

-

Starting & Managing Payment Services3 months ago

Starting & Managing Payment Services3 months agoPartnerships and Collaborations: Expanding Your Payment Service Reach

-

Agent Programs & Merchant Services3 months ago

Agent Programs & Merchant Services3 months agoPotential Pitfalls in Adopting New Payment Technologies

-

Credit Card Processing & ISOs3 months ago

Credit Card Processing & ISOs3 months agoUnderstanding the Dynamics of Chargebacks and How to Contest Them